Why Exit Planning is Essential for Business Success

Exit planning, although often only associated with the end of a career, is actually both a starting and end point. It’s not just the final stage. Exit planning is about preparing and implementing systems throughout the business’s life that protect and grow value so that you can maintain a profitable business today and possess an attractive business to potential buyers. Let’s examine the facts about exiting a business and discuss how exit planning is a good business strategy to implement over the life of a business.

Owner Readiness

According to a recent State of Owner Readiness survey conducted by the Exit Planning Institute (EPI), 99% of business owners agreed that a transition strategy is important for realizing future personal and business goals. However, 94% had no “life-after” plan, 79% had no written exit plan in place, and 49% had done no planning at all! Equally disturbing is that 63% of owners planned to transition within the next ten years. The saddest news is that, according to EPI, over 70% of businesses on the market do not sell. This is even true of family-owned businesses; only 30% transition into the second generation and only 12% into the third.

What is Exit Planning?

Exit planning is a process of operating a business through thoughtful planning, effort, and strategy that is transferable due to its strong structural, human, customer, and social capital. This concept interweaves an owner’s personal, financial, and business goals into a cohesive plan that focuses on creating business value today.

What is Value?

When a business is offered for sale, the price of the business is composed of two different parts: the tangible and the intangible assets. Tangible assets are those things that show up on the business’s balance sheet. Only about 20%-30% of a business’s value comprises tangible assets. The intangible assets make up as much as 80% of the value of the business. These intangible assets include the four capitals (structural, human, customer, and social) that manifest as goodwill, management strength, reputation, operations, and company culture. Inattention to intangible assets prevents businesses from successfully transitioning, which is why attending to these important aspects of business is a must to improve the value of a business.

Focusing on Value

It should be noted that value and income are not synonymous. Focusing on income keeps some business owners entrenched in maintaining their current lifestyle with little thought of their next chapter in life. Fortunately, focusing on the intangibles that add value to a business are best practices that should generate more income now while improving future value.

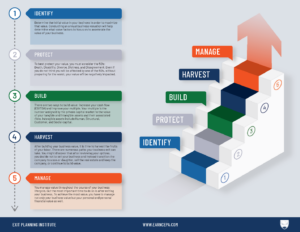

Business value improves through a cycle called value maturity. The Exit Planning Institute has developed a Value Maturity Index™ to help owners and advisors move through a value enhancement process called Value Acceleration Methodology™. This methodology begins by identifying the current value of a business, protecting the value by de-risking actions, and building the value through improving the intangible capitals of the business. Once the business value is in a growth curve, the owner can manage the business and further increase value or choose to harvest the value of the business through a transition event.

As you can see, exit planning is a comprehensive endeavor that requires meticulous preparation and a targeted approach. It’s not a step taken at the last moment; it’s a strategy woven into the fabric of your business. In the dynamic business world, where change is constant and the future uncertain, a well-crafted exit plan shields against unexpected storms. The exit isn’t an end; it’s a new beginning. Learn More.