The Wealth Gap and How CEPAs Can Help You Close It

Business owners have about 80% of their net worth locked up in the business; therefore, only 20% is liquid (Snider, 2023). Owners expect the stockpile of wealth to be unlocked in the future when the business transitions. However, experts tell us that 80% of businesses on the market fail to sell. All that wealth is useless if the company is not transferable! Sadder still is the owner’s dependence on that wealth to live well in their next act. Such owners have come face-to-face with their wealth gap. They must retire with less to live on, which is likely why 75% of business owners “profoundly regret” selling their business 12 months later (Snider, 2023).

What is a Wealth Gap?

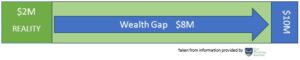

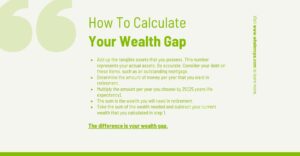

A wealth gap is the difference between expectation and reality (Goodbread, 2023). It happens when owners assume a business value that never materializes. It results from adding the owner’s actual assets to a “guess” of their business’s value. Below is an example to consider.

Suppose you have actual assets of $2M. These assets are in your house, cars, IRAs, and other tangibles. The value of the business is not considered at this point because you do not know the actual value you will reap. Suppose also you wanted to have $400K per year in retirement. To live on $400,000 per year for 25 years, you would need $10M.

$400,000/year X 25 years=$10,000,000

Since you currently have $2M, you are $8M short of your goal. In this example, $8M is your wealth gap.

Now is the point at which you begin to factor in the value of the business. In our example, the owner would need the net proceeds from the sale to be $8M to close their wealth gap. If realizing net proceeds of that magnitude is impossible, then the owner cannot close the wealth gap, and lifestyle adjustments are necessary.

Calculating the wealth gap shows how far away the goal is from reality. If the owner in our scenario is retiring, suffering from health problems, or facing other life obstacles and discovers the gap at the time of exit, the expected $400K per year reduces to $80K per year, based on the actual wealth they possess. It would be devastating to realize too late that your retirement budget is five times lower than expected!

This example should reinforce that exit planning is a good business strategy, not something that occurs when the owner is ready to sell. It should also motivate all business owners to examine their wealth status closely now. Fortunately, owners motivated to close the wealth gap can begin a journey to improve the value of their business, which in turn can help make their goals a reality.

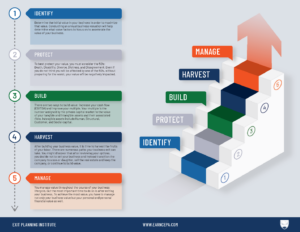

To help you design an achievable plan, consult a Certified Exit Planning Advisor (CEPA). CEPAs help owners think about the state of their business throughout the company’s life. They can help owners improve the value of their company by using de-risking strategies like improving operations, guiding compliance, and helping develop written policies and procedures (structural capital), all things that impact the value of a business. De-risking helps owners protect what they have and paves the way for future growth.

Once de-risking is complete, CEPAs can guide owners into improving the profits and value of their business. Owners address their company’s human (people), customer, and social (culture) capitals. Since these intangibles make up 80% of the value of a business, it is easy to see that these improvements can significantly increase the sale price. Through a carefully constructed individualized plan, owners can take control of their companies and gradually implement changes that directly influence their business’s selling price.

Whalen CPAs has two CEPAs who are ready to assist you. Imagine the peace of mind that comes from acknowledging your wealth gap and devising a plan to close it.

Resources

Goodbread, J. (2023, August 21). Financial planning for business owners [Presentation]. CEPA: 2023 August, Online.

Snider, C. M. (2023). Walking to destiny (2nd ed.). Think Tank Publishing House.